House prices fell for 6 years after peaking, banks defaulted, construction companies went bankrupt, the whole world struggled for 10 years

According to the New York Times, Sri Lanka used to be the ideal choice for the second home of many foreigners with real estate up to millions of dollars. The trend of people buying speculative houses exploded in this country when villas near the beach or tourist areas, with a warm climate all year round, became an attraction for the rich.

So instead of investing in manufacturing industries, Sri Lanka put all its efforts into tourism as well as real estate speculation around it. Most of the products here are “Made in…” in a certain country. As a result, when the financial system collapsed, the entire society was plunged into chaos.

In fact, the story of people rushing to speculate on real estate, creating a market bubble that risks to the financial system is not uncommon.

If Sri Lanka is a lesson in speculating too much on tourist real estate and neglecting other manufacturing industries, the 2008 crisis in the US is a typical story of a housing bubble. Fortunately, the world’s No. 1 economy recovered, but in return the whole world had to sink during 10 years of struggling to get out of the aftermath of the 2008 crisis.

Now that housing prices are getting hotter globally, including the US, will history repeat itself?

Reverse history?

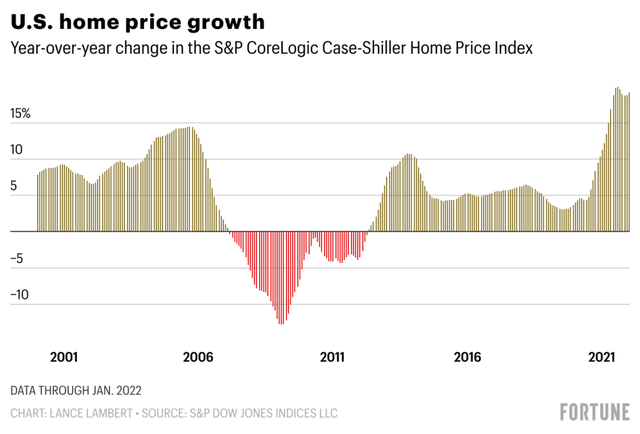

In the post-pandemic time, the supply disruption of the market and the reopening of the economy caused housing prices in the US to increase again. Bloomberg news reported that home prices in the US increased by more than 18% between November 2020 and November 2021, much higher than the 4-8% average of the previous two years. This is also much higher than the 2000s house price surge that preceded the 2008 crisis.

However, according to Moody’s, the current housing situation is not so dangerous as before the US government had more stringent standards and regulations for credit than 15 years ago. This means there will be fewer individuals or organizations at risk of bankruptcy if house prices go down.

Sharing the same opinion, CNN said that today’s credit standards in the US are different, so the real estate market is also safer, but the downside is that few people remember the lesson of the 2008 bubble anymore.

Fortune reported that home prices in the US increased by 19.2% in January 2022 compared to the same period last year, higher than the 11.3% announced in January 2021. This figure has surpassed the peak of 14.5% average in 2008 and created anxiety among some experts.

According to Fortune, most homebuyers suffer from “Fear of Missing Out-FOMO” when the market appreciates after the pandemic, thereby pouring more money into real estate and further increasing the market. hotter field.

Fortunately, the Dallas Fed’s report shows that the market is still safer today than it was in 2008. The data shows that total household disposable income is used to mortgage real estate in The US is currently only about 3.8%, much lower than 7% in 2008.

Mortgage rates will rise, and in theory, they should drive more buyers out of the market because they can’t afford to pay, said Devyn Bachman, vice president of real estate research at John Burns Real Estate Consulting.

However, in 2008, the heat of the real estate market made many Americans continue to take out mortgages despite continuously high interest rates. The banks also lent despite the increasingly large risk ratio, thereby creating the consequences of the crisis spreading to the whole economy.

But Fortune said about 99% of real estate mortgage loans today have fixed interest rates and certainly both the Fed and the US government will step in if history shows signs of repeating itself again.

Lesson 2008

The story of the collapse of the US housing market in 2008 is no stranger to the US media when more than half of the states of this country fell into the scene of a deflated real estate bubble at that time. Home prices in the US peaked in early 2006 and then began to decline throughout the period until 2012.

However, most speculators at that time bought houses in the form of mortgages (Mortage) and when supply exceeded demand, house prices fell sharply, making many people unable to pay, forcing banks to squeeze debts and put them up for sale. cheap houses to recover capital. This move makes the market even more deflated when there are too many affordable homes but the demand is limited.

On December 30, 2008, only Case Shiller’s home price in the US had a record decrease and the story of the deflation of the real estate bubble had affected the US financial system, credit as well as the banking industry. heavy.

The devaluation of real estate not only made brokerage businesses suffer, but also caused the banking industry to default, unemployment construction companies, many equipment suppliers to be dissolved while countless households were broken. for mortgage loans. The consumer sector and many other sectors of the economy are also affected as people fear spending.

The situation was so serious that President George W Busk and Chairman Ben Bernake of the US Federal Reserve (FED) then had to launch a package to assist those who could not afford mortgage payments.

In 2008 alone, the US had to spend up to $ 900 billion to bail out the real estate market, but still, countless financial institutions declared bankruptcy. The 2008 crisis caused the US government to review credit and banking industry standards and it took nearly 10 years for the world’s No. 1 economy to come out of the bubble.

*Source: Bloomberg, CNN, Fortune

Following Economic Life

at Blogtuan.info – Source: cafebiz.vn – Read the original article here