8 “fatal” mistakes in financial management, before the age of 35 definitely must not be made

Mistake 1: Not having a financial management plan

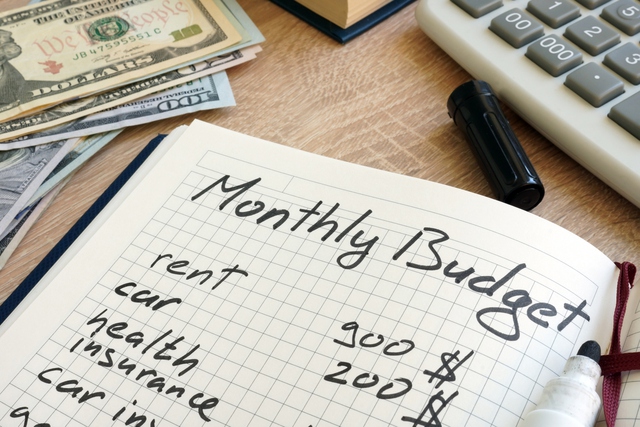

The first step in financial management is understanding your overall expenses. So it’s best to plan ahead how much you’ll need for rent, insurance, living expenses, or entertainment.

For example, rent cannot exceed one-third of your salary or living expenses, insurance will account for one-third of your monthly expenses… You also need to list your expenses in order of priority. This allows you to quickly see where your money is being spent, control spending more effectively, and make long-term financial planning possible.

Mistake 2: Spending without recording

To avoid the “shock” of realizing your account is empty at the end of each month, take 5 minutes a day to record your spending.

Reviewing your large and small expenses on a regular basis will help you identify some that are not really necessary and consider cutting them off in time. For example, the monthly membership fee of a gym that you only come to a few times because you are too busy (or lazy) can be reduced, you should consider paying by each training session to reduce waste. Or food, taxi … can also be adjusted more reasonable.

Recording expenses is also a way to learn your spending trends, thereby optimizing consumption habits. You can use mobile applications specifically designed for this, which are extremely light and convenient.

Mistake 3: Not having specific savings goals

Clear savings goals will motivate you to spend more rationally. Without these goals, you will easily fall into the trap of spending according to interest or mood, thereby leading to unnecessary waste.

Set clear goals, such as paying off your school loan, saving up a down payment to buy a house, traveling around the world in 10 years… At each stage of your life, you’ll have different goals, and your friends will surely thank you for those accumulations.

Mistake 4: Investing without careful research

If you have money to spare and hope to make money by investing, do your research or find yourself an expert. You need to remember, investing is a way to make money with knowledge and vision, not a gamble of chance.

Mistake 5: Never paying off your credit card debt, only paying the lowest possible payment

If you don’t pay your card fees on time, you’ll have to pay additional penalties and recurring interest on the next month’s bill. Even if you’ve made the minimum payment, the remaining unpaid balance will still be added to the next month’s spending to continue calculating interest.

To avoid forgetting payments, you can set up automatic debt deductions and keep your consumption within an acceptable range, avoiding the possibility of not being able to pay when your bills are due and having to pay extra interest on your bills. bank.

Mistake 6: Not buying insurance or buying too much

Some elderly people think that buying insurance early is very bad luck, but there are always force majeure situations in life, and choosing the right type of insurance has long become a necessary measure to cope. deal with the risks in life.

But it should be noted that buying insurance must depend on the actual situation, buying too much or too little will affect your benefits.

Mistake 7: Relying too much on credit cards

Credit cards are convenient, but it’s easy to fall into the trap of buying indiscriminately. Be wary, if your salary is 10 million dong but every month you swipe 15 million dong, it means you have spent more than the allowed amount, you need to stop as soon as possible.

If you can’t stop swiping, use cash.

Mistake 8: Wanting More Than Needing

Before swiping a payment card, have you ever thought about whether you buy this product because you need it, out of excitement or just to pass it on to someone? In many cases, thinking an extra half minute will save you a lot.

Many people often think that when they are young, they should live comfortably for a while, what will be calculated later, but actually thinking that is not advisable. Having healthy consumption habits from a young age will be the premise for a peaceful and stable life later. Don’t make yourself lose money in a “scattered” way or get into unnecessary trouble.

at Blogtuan.info – Source: cafebiz.vn – Read the original article here