The domestic gold price has a record difference with the world gold price

High spread

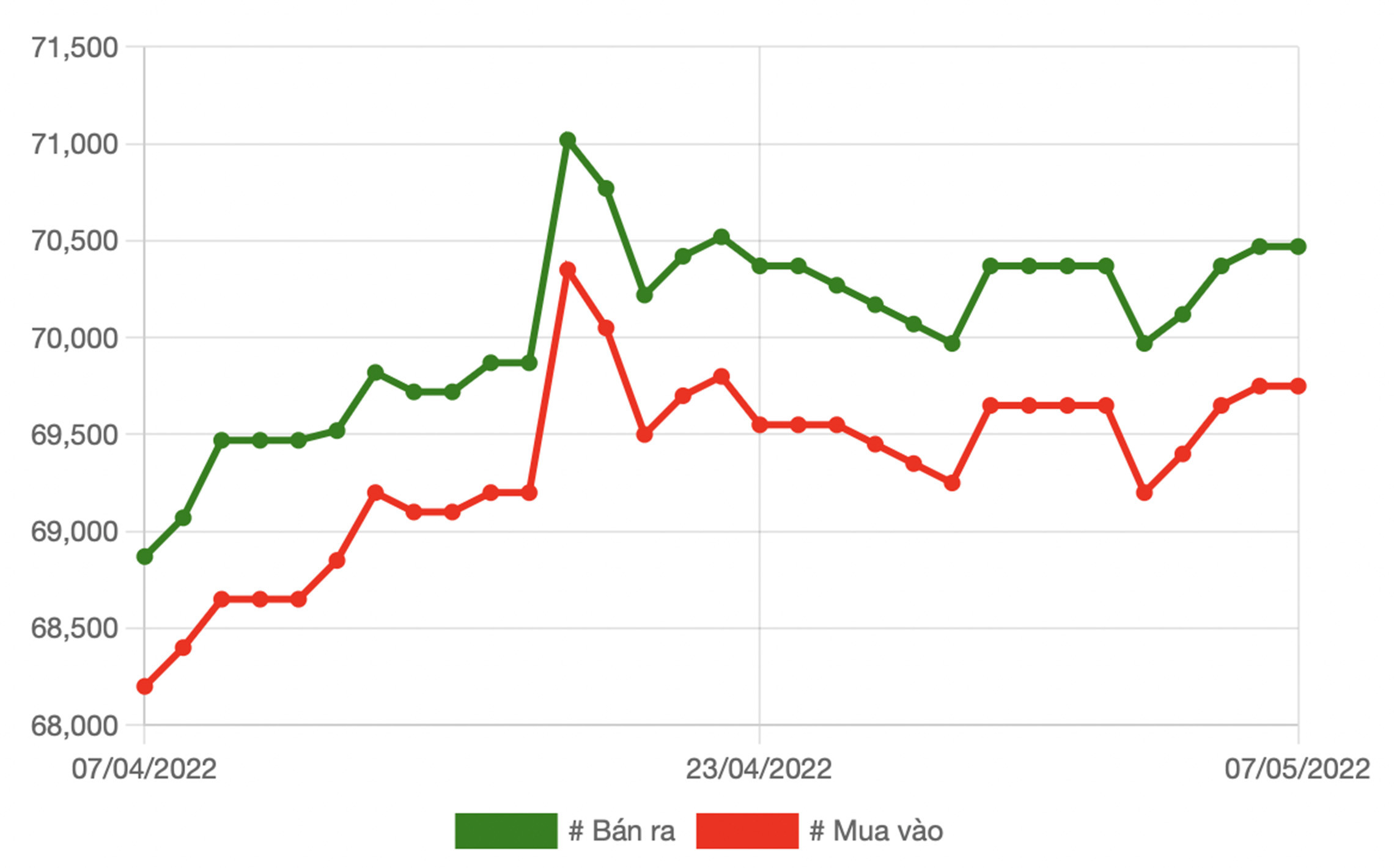

At the end of the trading session on May 7, the price of 9999 gold bars at SJC Hanoi was 69.75 million VND/tael (buy in) – 70.47 million VND/tael (sold out). SJC Ho Chi Minh City listed at 69.75 million dong/tael (buy in) and 70.45 million dong/tael (sold out). Doji Hanoi listed at 69.6 million dong/tael (buy in) and 70.4 million dong/tael (sold out). In Ho Chi Minh City, Ho Chi Minh City Doji bought SJC gold at 69.8 million VND/tael and sold it at 70.4 million VND/tael.

World gold strongly fell below the threshold of 1,900 USD/ounce, but the domestic gold price was still anchored around the 70 million dong/tael mark, 18-19 million dong/tael higher than the converted world gold price.

Last week, the gold price had a time when it lost 70 million dong/tael. Specifically, the session on May 3, gold price 9999 In Hanoi, Saigon Jewelry Company SJC traded at 69.2 million dong/tael (buy in) and 69.97 million dong/tael (sold out), down 450 thousand dong in the buying afternoon and decreased by 400 thousand dong in the afternoon of selling compared to the end of the trading session on April 29. This is a rather strong decrease in SJC gold price compared to before the holiday.

The price of 9999 gold in Hanoi was traded by Doji Jewelry Group at 69.55 million dong/tael (buy in) and 70.25 million dong/tael (sold out), the price remained unchanged compared to the end. trading session on April 29.

According to the World Gold Council (WGC), the gold demand of Vietnamese consumers increased from 18.6 tons in the fourth quarter of 2021 to 19.6 tons in the first quarter of 2022.

Gold price forecast

On the world market, the price of gold for June delivery increased by 7.1 USD, or 0.4%, closing the last session of the week at 1,882.8 USD/ounce. For the whole week, this precious metal lost 1.5% of its value, marking the third consecutive week of decline.

The global gold market rebounded in the first quarter of 2022, up 34% year-on-year, driven by strong ETF inflows, reflecting gold’s status as a safe-haven investment during the period. geopolitical and economic instability.

Optimism improved among Wall Street analysts and retail investors as the Federal Reserve laid out its monetary policy plan throughout the summer.

According to the WGC, this growth was driven by a 4% increase in total demand for bullion and gold coins, from 13.5 tons in the first quarter of 2021, to 14 tons in the same quarter of 2022, and demand for luxury goods. jewelry increased 10%, from 5.1 tons in Q1 2021 to 5.6 tons in Q1 2022.

Mr. Andrew Naylor, World Gold Council, said that rising inflation and weakening of the dong in Vietnam have increased the attractiveness of gold as demonstrated by high domestic premiums. Local festivals including Lunar New Year in February, Valentine’s Day and God of Fortune’s Day have supported a year-over-year increase in jewelry demand, along with a recovery in activity. business to pre-Covid-19 levels.

The first quarter of 2022 was a tumultuous one, marked by geopolitical crises, supply chain difficulties and inflation, said Louise Street, senior EMEA analyst at WGC. growth increases. These global events and market conditions have cemented gold’s position as a safe-haven, not only for investors but also for retail consumers thanks to its unique position. it.

According to Robert Minter, director of investment strategy in ETFs at ABRDN, investment demand in gold will increase this year, when interest rates rise and inflation is high.

Told him

at Blogtuan.info – Source: vietnamnet.vn – Read the original article here