“This 18-20 years I’m not in the business of making money from my own stocks”

That is information shared by Mr. Nguyen Duy Hung, Chairman of the Board of Directors of SSI Securities Company (stock code: SSI) at the company’s 2022 Annual General Meeting of Shareholders taking place on the afternoon of May 7.

It hurts when the stock drops even though the business results are still good

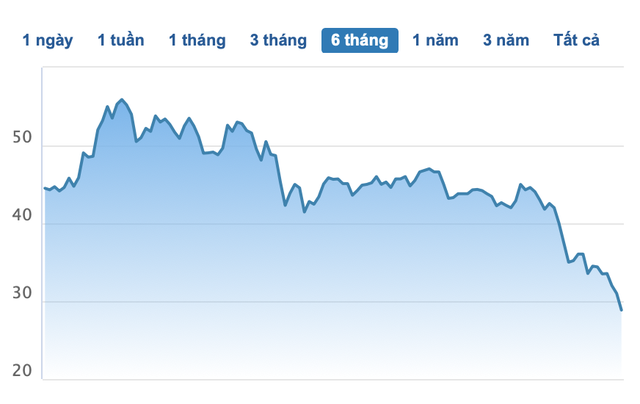

SSI shares closed the trading session on May 6 at 28,800 VND/share – halving from the peak. SSI’s capitalization dropped to 31,768 billion dong. Therefore, at the AGM, there were many questions related to the company’s shares falling deeply and recent stock market fluctuations.

SSI share price in the past 6 months

The question of business results is still good, but the stock has fallen deeply, touching the heart of the Chairman of SSI. He shared: “This is the most painful and difficult thing for me, people can see me and my family never buy any SSI shares without announcing. I don’t join any group. I’m going to say this publicly, if I have, everyone will find out. I just do the best development of the company, protect the interests of shareholders. . I also like stocks going up, when they go up, they have a lot of assets, but the stock price is determined by the market.”

Mr. Hung emphasized that SSI’s stock did not decrease in isolation but in general in the trend of the market. Currently, there are many views on investors that the market from liquidity of 30,000-40,000 billion to 14,000-17,000 billion, securities companies have no chance. But the company’s plan can be achieved. SSI’s Board of Directors submitted a consolidated business plan in 2022 with revenue of VND 10,330 billion, up 31% and pre-tax profit of VND 4,370 billion, up 30% over the same period in 2021.

When asked by investors about losing money when holding shares, does SSI have a way to “save” shareholders, Chairman Nguyen Duy Hung said: “SSI only has a way to make everything transparent and safe, Taking advantage of market opportunities for the company to develop well, SSI cannot directly participate in buying or selling shares.”

About Mr. Hung himself, when asked by shareholders about whether the stock has fallen deeply, he has a plan to buy shares, he frankly said: “For 18-20 years, I have not been in the business of buying and selling my own stocks for profit. , the stock that I have now is from the early days of establishment until now”.

When money is no longer cheap, securities in 2022 still have a chance for non-borrowed cash flow

At the general meeting of shareholders, in response to the question of whether the cash flow will be reduced in 2022, Mr. Nguyen Duy Hung said that the stock market has two functions: a place to mobilize capital and organize secondary transactions to create liquidity for the market. Investors control their assets. The stock market itself doesn’t make money, so there are cycles. When cheap money is injected, those who accept risks and speculate on assets will gain a lot of profits, when money is no longer cheap, profitable assets can make profits in the financial market.

“I think that when capital is expensive, there are opportunities for foreign cash flows to join the Vietnamese stock market. For domestic investors, if they buy cheap, there are people who sell cheaply, and when they buy expensive, there are people who sell expensive… Due to different investors’ ability to manage risks and determine the future of the stock market, there will be different transactions.

It is because of different opinions that there are buyers and sellers, but if the judgments are the same, no one will buy or sell,” said Mr. Hung.

The President of SSI believes that the 2022 opportunity of those with non-borrowed cash flow, profitable for a period of time, such an investment is much safer than “swinging to the top”, ie buying and waiting for the price to rise but not I don’t know why prices go up and down.

Liquidity of 14,000-17,000 billion/session is still ideal, the market is not too tragic

Regarding liquidity, it dropped to only VND 14,000 – 17,000 billion, Mr. Hung said, the last trading sessions of 2021 are the dream sessions of securities traders. The number 14,000-17,000 billion, although a decrease compared to before, is still an ideal number, although many people compared to the end of 2021 see something terrible.

Mr. Hung assessed that such a decrease in liquidity will affect securities companies, but it is not possible to apply the above dream conditions to real life forever. The number 14,000-17,000 billion/session is still a dream number. However, SSI has not adjusted its business plan for 2022. In 2021, the company achieved the highest peak business results in 21 years of operation. If there is a big change, the company will immediately submit it to the general meeting of shareholders.

“Many fluctuations happened such as epidemics, the Ukraine-Russia war in the first quarter, but the company’s business results were still good. If we set an ambitious plan, if we lower the plan immediately, it will be very sorry for shareholders because I can’t do it, as Chairman and biggest shareholder I also disagree. The plan is to execute. We have not seen the need to adjust the business plan. We have not seen the market yet. too bad, the will of the Government, the interest of investors, the foreign money flow is not as tragic as we see it”, Mr. Hung said.

“If relying on short-term factors to buy and sell, investors can lose money”

The Chairman of SSI emphasized: “In the securities business, for short-term forecasting, macro people like me are not gifted. I care about the long-term prospects of an economy.”

Currently, the market has many uncontrollable external factors. War can end globalization, cut off supply chains, increase shipping prices… However, in risks is opportunities, for example we can sell food to Arabia when other supplies are cut. In the first quarter, Vietnam’s agricultural product industry developed very well. Relying on short-term fluctuations can cause many investors to lose money.

“Investors who decide to buy or sell based on short-term fluctuations will often lose. However, if we rely on long-term macro analysis, it will be better. Currently, SSI borrowing money abroad is very expensive. Domestically, domestic banks increase mobilized capital, but now it is very easy to mobilize foreign capital. It is also an additional source of credit to the market,” said Mr. Hung.

The increase in interest rates will affect financial businesses. Currently, SSI has a good capital advantage, with a large capital owner, 4.5% foreign loan. The average cost of capital has not been affected, so the Company is still maintaining the current policy of margin interest. Of course, the company has a very high risk management policy, so it does not have to provide margin for all shares. The company is still able to expand its loan balance while maintaining current lending rates.

Recently, the company announced that it has successfully signed and completed the disbursement of a credit loan contract from a group of foreign financial institutions worth $148 million. This is the largest foreign mortgage contract that a Vietnamese securities company has access to at present.

Last year, SSI also had access to the largest source of foreign unsecured capital in the securities industry with USD 267.5 million, including a syndicated loan of USD 118 million from Fubon and UBOT – successfully connected by Block IB. SSI.

at Blogtuan.info – Source: cafebiz.vn – Read the original article here