VN-Index fell for 6 consecutive weeks, the longest in more than 10 years, when will the pain stop?

Vietnam’s stock market has just ended a terrible week when VN-Index lost 146.49 points, officially setting a “sad record” with the strongest drop in history. In terms of relative numbers (-11.02%), this index also recorded the strongest week from March 9-13, 2020 (-14.55%). This is also the first time VN-Index has dropped below 1,200 points after more than 13 months since March 31, 2021.

VN-Index fell below 1,200 for the first time in more than 13 months

Last week’s plunge pulled the VN-Index’s losing streak to 6 consecutive weeks, the longest in more than 10 years. The last time this index fell for 6 consecutive weeks was in the period of September 12-21, 2011 with a decrease of 10.6%. Thus, in its 22-year history of operation, Vietnam’s stock market has witnessed 11 consecutive declines of the VN-Index for 6 weeks or more.

Statistics show that this reduction chain has the highest level of fierceness, although it is not the longest time. Falling from the historic peak, it is not surprising that the VN-Index recorded an unprecedented drop in absolute terms (333.67 points). This number is even higher than the VN-Index’s score in many periods in the past.

In relative terms, the decrease of 22% in the past 6 weeks is also only after the 7-week series of declines from 5/5-20/6/2008 (-29.9%) and the 9-week decline period from 19 11/2001-18/01/2002 (-30.1%). Even the longest losing streak in the history of 15 weeks from December 23, 2002 to April 11, 2003, VN-Index only lost 19.3%.

11 times VN-Index decreased in a row for 6 weeks or more

The chain of continuous decline week after week with a large margin and still shows no sign of ending, making the psychology of most investors become confused. It is difficult for the bottom-fishing cash flow to enter when the stock seems to be bought at a cheap price, but not yet in time to the account, the price is cheaper.

Sharing about the market related to investor’s pressure and psychology, SGI Capital said that it is rare for investors to have to bear many worries at the same time as now: from inflation pressure, rising interest rates, Ukraine conflict, Fed tightening, China lockdown, corporate bond market tightening, speculation control, real estate credit restriction…

“As a result, we have a valuation of VN30F 2022 at a rare low of 11.x, almost equivalent to periods of crisis. Our many years of experience in investing in the stock market show that bad news and bad news. Pessimism is always an investor’s good friend. The more bad news, the greater the anxiety and caution, the cheaper the valuation, and the higher the investment efficiency will be,” said SGI Capital.

In fact, after a series of days of painstakingly decreasing, the P/E of VN-Index has now retreated to 12.71 times, a significant discount from 16.4 times when the index reached its peak in April 2022 and was low. significantly above the 10-year average (14.5 times).

According to JPMorgan, Vietnamese stock P/E has rarely traded at valuations below the 10-year average for more than two months. Therefore, the organization believes that the adjustment is difficult, but it will not be long.

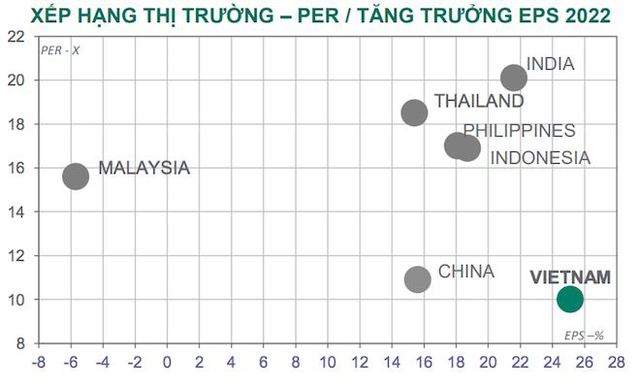

Similarly, Dragon Capital believes that the current attractive valuation of the Vietnamese market becomes even more prominent when compared to other markets in the region. While it is still unknown in the short term, the profit potential for long-term investors is very clear.

Compare PE of VN-Index with regional markets. Source: Dragon Capital

More cautiously, Mr. Bui Van Huy – Director of HSC Securities Brokerage said that “Cheap prices can still be cheaper, so investors need to be more careful and slow in their bottom-fishing decisions.

Even in the argument that the Vietnamese market is cheap, with a forward P/E of ~ 12-13 times, there are many things to criticize if analyzed carefully. Indeed, the P/E forward is not lower than many major markets such as Europe, Japan, China and many emerging markets.

Sharing the same view and even more pessimistic, Mr. La Giang Trung – CEO of Passion Investment said that the market has not yet created a bottom with the comment “Statistics show that at the end of an economic cycle, the market usually drops 30-40%. % from the peak. With the Fed tightening interest rates and inflation, the Vietnamese market will go to about 950 points.”

at Blogtuan.info – Source: Soha.vn – Read the original article here